Back to blog

Why Storing Data on Ethereum Costs as Much as a Penthouse

Storing data on Ethereum isn’t just expensive, it’s luxury-real-estate expensive. That means when you see those 🙌 💎 filling up your X feed because crypto prices are going up, so are storage costs, and suddenly even a few kilobytes of on-chain data feel overpriced. On Ethereum, storage fees rise with asset price, not with efficiency gains. Every bull run makes it pricier to store even a few kilobytes of data.

The storage approach that works for an MVP or POC quickly breaks when you try to scale.

This isn’t just a developer headache. It’s a nightmare for anyone building any company touching crypto. The wrong choice for file (data) storage can quickly destroy margins, and eliminate profitability, threatening the very growth the projects were built to capture.

This is why IPFS is such a natural fit for builders that want immutability without burning through runway. To better understand what this looks like, let’s take a closer look at the numbers.

The Ugly Math of On-Chain Storage in 2025

Yes. Gas fees swing up…but have been mostly down the last few years. In 2025, averages hover around 1.56 Gwei, with record lows at 1 Gwei and spikes as high as 3.15 Gwei. But whether gas is cheap (or not) isn’t the point. The structural issue is that storage costs are tethered to ETH itself.

As ETH appreciates, storage costs do, too.

Take calldata: each byte costs ~15.95 gas. Plug in 12 Gwei and ETH at $2,300, and suddenly you’re paying $460 per MB or $460,000 per GB. Even in a “low gas” environment, that’s not cheap.

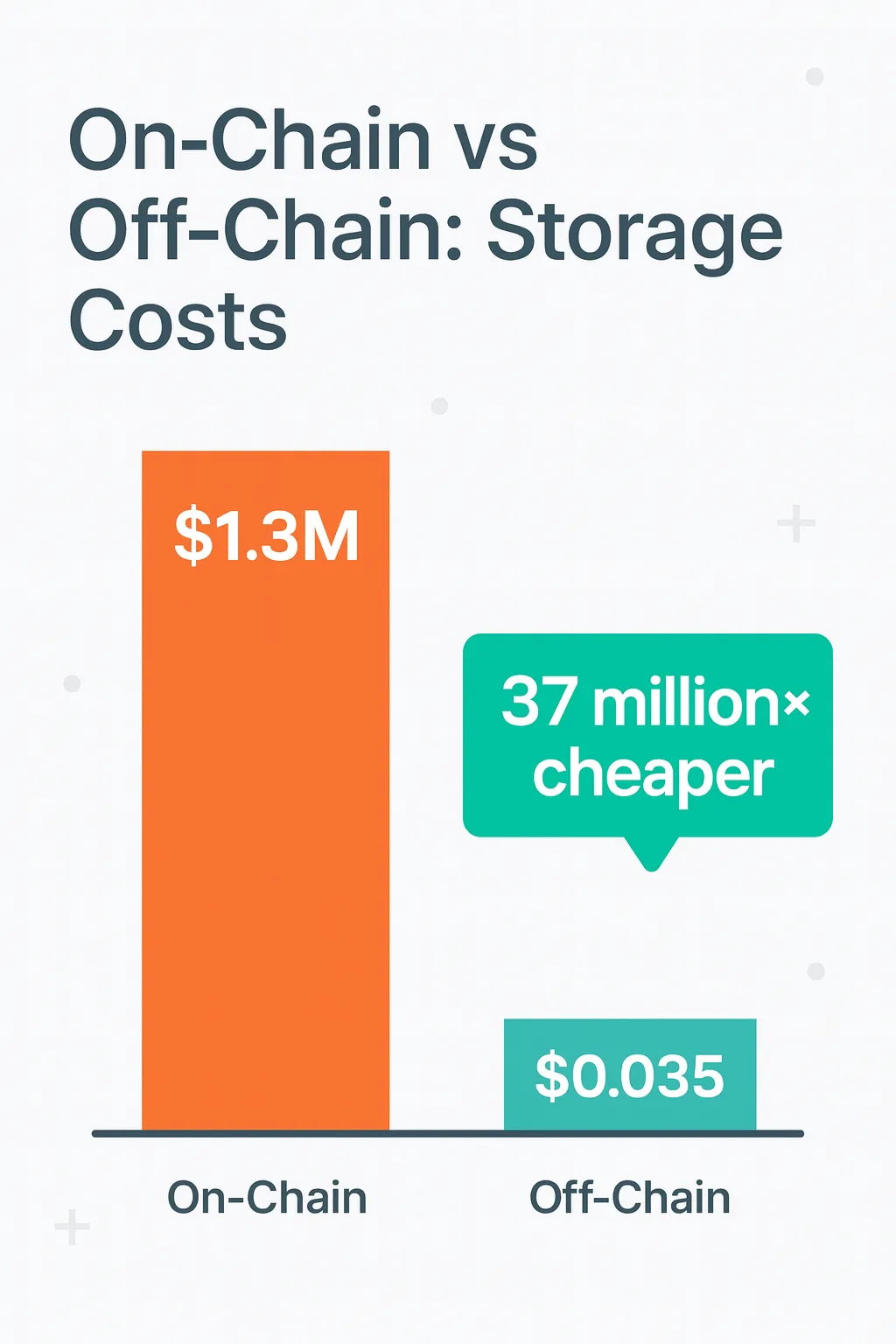

Smart contract storage looks even worse. In 2016, it was estimated at $76,000 per gigabyte. Today, the community estimates push that figure closer to $1.3 million per gigabyte.

The bottom line: on-chain storage isn’t getting cheaper with time like traditional infrastructure. It only gets more expensive the more successful ETH becomes. That’s less like a feature and more like a permanent tax on growth.

P&L Math: Scale Your Users, Kill Your Margins

And this tax isn’t a one-off…these numbers get punishing fast.

A single 200MB high-res NFT costs about $92,000 to store on Ethereum. Scale that to a 10,000-piece collection and you’re looking at $2.6 billion in storage. (NFTs popularized IPFS for a reason 😉)

Media-based builders aren’t alone either; DeFi projects hit the same storage cost wall. Millions of tokens each carry kilobytes of metadata, which adds up to millions in annual fees. Oracles and RWAs are no different. Tokenizing 100GB of real estate documents alone runs about $130 million.

Scale that to bonds, commodities, or compliance data and you’re in the billions. Every extra gigabyte stored on-chain eats straight into margins…until they’re gone entirely.

But don’t worry, on-chain storage costs aren’t going to kill an entire industry. There is a smart, secure, and scalable alternative that is WAY more effective (and so much easier to use).

Why the Smart Money Stores Data on IPFS

IPFS, or the Interplanetary File System, makes any digital item — user or transaction data, NFTs, token metadata, audit logs, video or media files, or even AI inputs and outputs — tamper-proof and fully verifiable.

NFTs were the first to adopt IPFS for file storage, as most artists were looking to spend as little as possible creating (and hosting) their NFTs. Zoom forward to today and the definition of what many consider an NFT has evolved tremendously while the underlying IPFS technology and networks have become more powerful.

Today, an NFT isn’t just an image of a bored ape, it could be logs from transaction metadata, supply chain outputs, a DEX LP position…or even an image of a bored ape.

That’s why IPFS shines. Content identifiers (CIDs) guarantee immutability without forcing you to pay Ethereum’s million dollar per gigabyte tax. Moving from a centralized, IP-based storage system to a decentralized, content-addressable system provide the immutability people expect from being on-chain, without the high costs or tokenization.

While IPFS is powerful, it’s easier to just use services (like Pinata) that add enterprise reliability; keeping files available, optimizing performance with replication, and offering predictable pricing at just $0.035 per GB per month, or about $0.42 per year without having to manage any infrastructure.

Same provenance and verifiability, radically different economics.

IPFS Is the Only Technically Right (and Cost-Efficient) Path to Scale

On-chain storage costs are structural, not cyclical.

Every increase in ETH price means higher storage costs…forever. With tokenization markets projected to reach $16 trillion by 2030 and the current NFT market already worth $11 billion in 2025, cost efficiency will define who wins. NFTs, gaming, RWAs, DeFi.

Every part of Web3 Needs a Storage Model That Doesn’t Collapse Margins as Adoption Scales.

That’s why moving data to IPFS with Pinata isn’t just a technical decision, it’s a structural advantage. Start with an audit of your current and projected storage needs.

Run projections comparing Ethereum and IPFS at 10x or 100x scale using tools like the Etherscan Gas Tracker or Gwei Converter. Pilot a setup where hashes stay on-chain while files live on IPFS. Then scale with Pinata for enterprise availability.

The math is clear. On-chain storage eats margins. IPFS isn’t just your favorite builders favorite storage anymore, it’s your favorite CFOs favorite storage solution, too.

Who wouldn’t want upgraded views without having to pay for the penthouse?