Back to blog

Crypto Forgets Where Reality Lies

Files, Tokens, and the Structural Mistake Behind Blockchains

Every system begins by resolving a constraint.

Crypto emerged from friction. Money moved slowly. Trust depended on intermediaries. Records relied on institutions remaining solvent and coordinated. Bitcoin compressed these pressures into a single surface. Ownership, transfer, and verification lived together. The record of what existed and the mechanism that moved it shared the same place.

That completeness shaped how the industry understands itself.

As crypto matured, that early model hardened into instinct.

In a recent opinion piece for The Economist, Larry Fink and Rob Goldstein describe tokenization as the recording of ownership on a digital ledger. A bond remains a bond when it lives on a blockchain. Settlement compresses. Paper disappears. Markets broaden. Capital becomes easier to move.

This framing reflects a real shift. Tokenization has moved from experiment to infrastructure. It is already changing how markets behave and who can participate.

The mental model supporting this shift formed early. Crypto began with native assets. Bitcoin and ether carried their reality directly. No external documentation (white paper, maybe?) was required to explain what they were or how they worked. The blockchain contained the full context of ownership and transfer.

That experience shaped how tokens came to be understood.

As tokens expanded to represent other forms of ownership, the same assumptions followed. Tokens began to stand in for real estate, funds, contracts, art, and financial instruments. These assets have always depended on documentation to describe their structure, obligations, and constraints.

Those documents remained where they had always lived.

They existed in folders, databases, email threads, and compliance systems designed for custody rather than coordination. Designed to persist in place rather than move with ownership. Designed to sit alongside markets rather than participate in them.

Tokenization ownership circulates independently of its documentation.

This is why tokenization hasn’t crossed the institutional chasm.

This reality separation alters how crypto behaves.

Tokens move fluidly across blockchains. Transfers became global. Settlement timelines compress. Markets appear increasingly liquid.

At the same time, the explanation of what is owned stays fixed. Verification relies on external systems. Understanding requires reconciliation. Confidence depends on institutions reassembling context as ownership changes hands.

As tokenization tries to accelerate, reality doesn’t follow it.

We’ve seen this firsthand while building systems where files, signatures, and ownership must remain coherent even as assets change hands.

Structure clarifies why this matters.

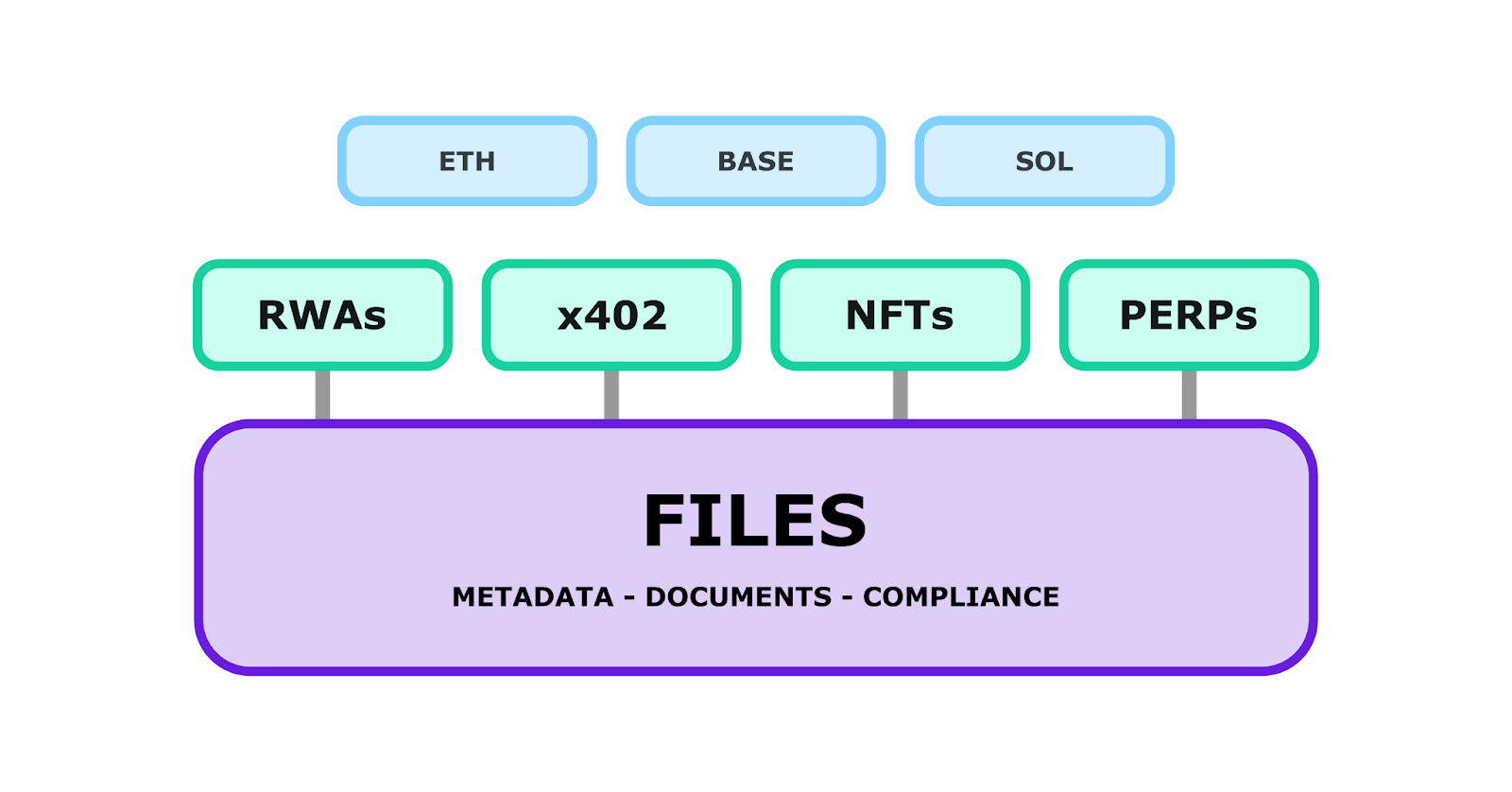

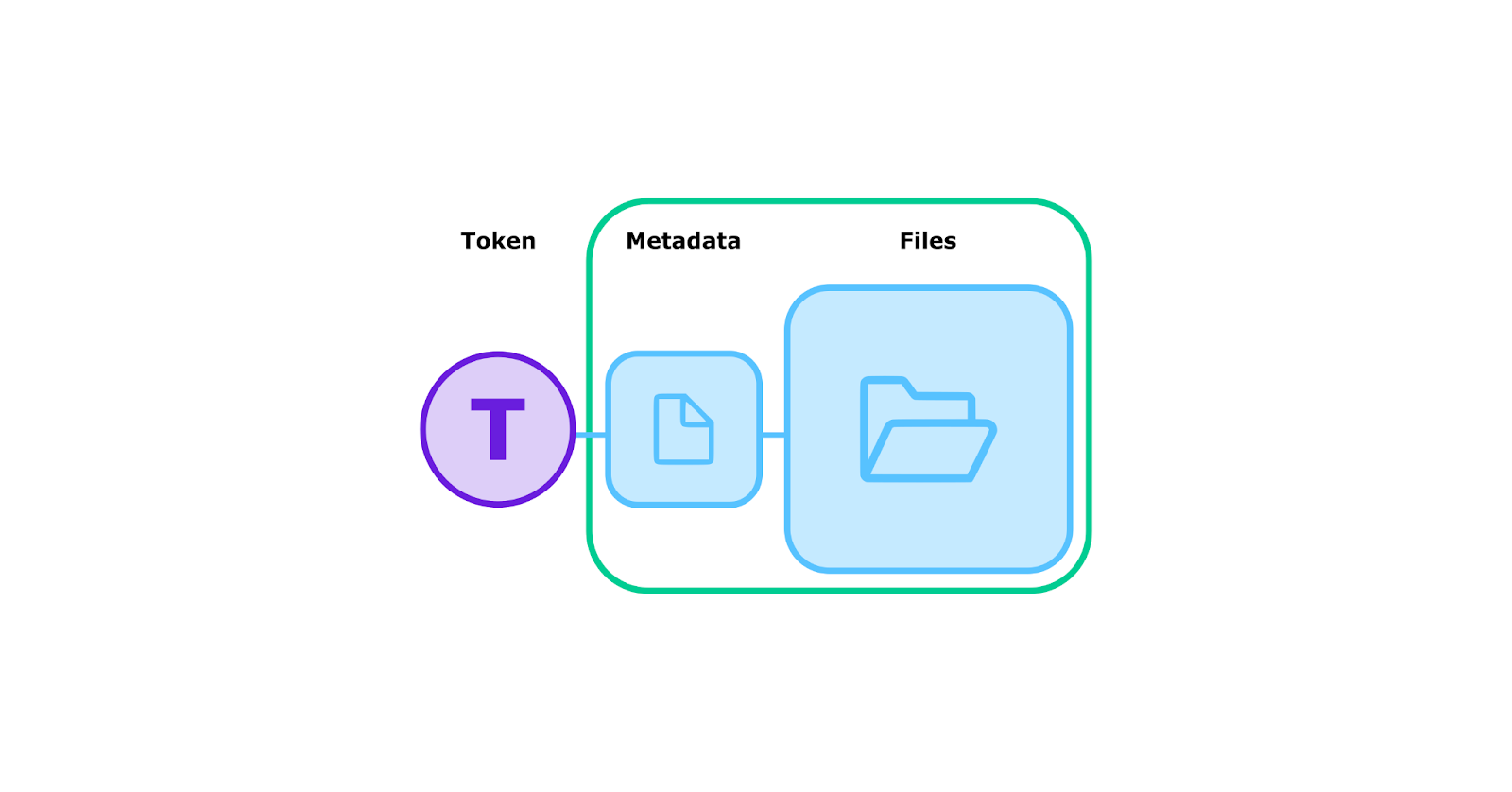

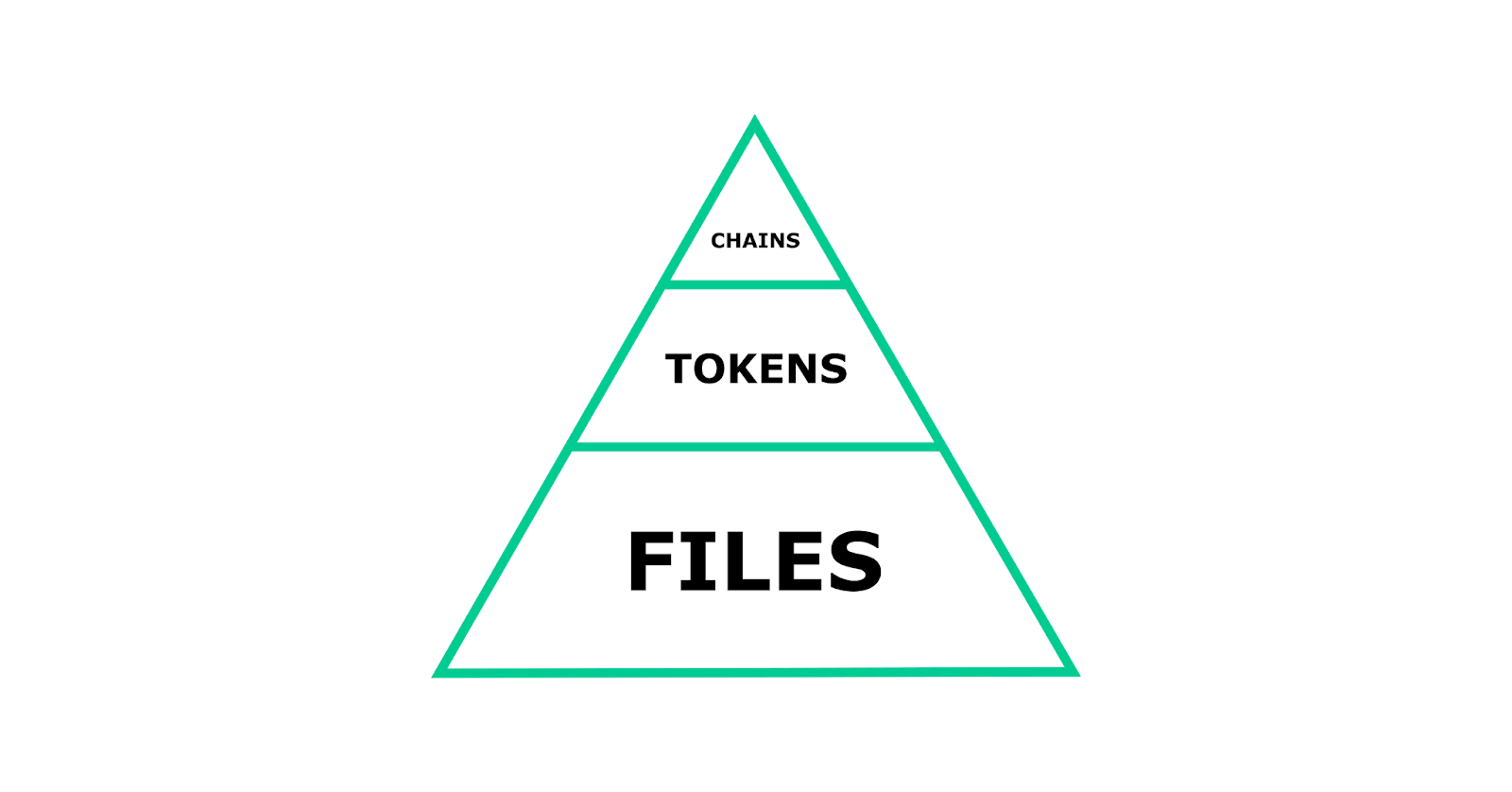

Files document reality. They describe what exists, the terms under which it exists, the constraints that apply, and the evidence that supports it.

Tokens define rights. They express who can claim, transfer, or exercise those rights at a given moment.

Blockchains coordinate movement. They allow shared agreement about how tokens travel and in what order.

Each layer serves a distinct role. Meaning emerges from their alignment.

As alignment weakens, systems lean on workarounds. Documentation becomes harder to track across transfers. Verification shifts outward. Processes that once lived inside markets reappear around them. After all, who are you going to email about documentation from a pseudo-anonymous crypto address?

This pattern appears across the ecosystem. Tokenized assets require private data rooms to interpret. NFTs persist while associated media changes or disappears. Compliance workflows exist separately from the blockchains they reference. Products advertise transparency while relying on offchain records to explain themselves.

Ownership remains active while understanding becomes lost.

Traditional businesses recognize this separation quickly. They ask about records, audits, permanence, and survivability. They focus on what persists when vendors fail or platforms change, and on how obligations remain legible as ownership moves.

Crypto-native builders approach the same systems from a different angle. Speed, coordination, and composability define success. The blockchain serves as the source of agreement.

Agreement alone does not mean reality.

That role belongs to files.

The promise of tokenization is real. Faster settlement. Broader participation. Fewer intermediaries. More flexible markets. The bridge that Fink and Goldstein describe is already being built.

But bridges require solid anchor points on both sides.

Ownership needs documentation that persists, explains itself, and remains accessible as systems evolve. That documentation has always taken the form of files.

Until those files are treated as first-class citizens, tokenization will keep accelerating without grounding, expanding without clarity, and moving faster than the structures meant to support it.

Crypto learned early how to move ownership at scale. The next phase requires preserving reality as that ownership moves.

As tokenization accelerates, the companies that win will be those who control how reality, documentation, and ownership stay synchronized. Without that alignment, crypto will continue drifting away from the reality it claims to represent.